*Some restrictions may apply. Please see below for details.

Manage the return process with the online store where you made the purchase and complete the claim.

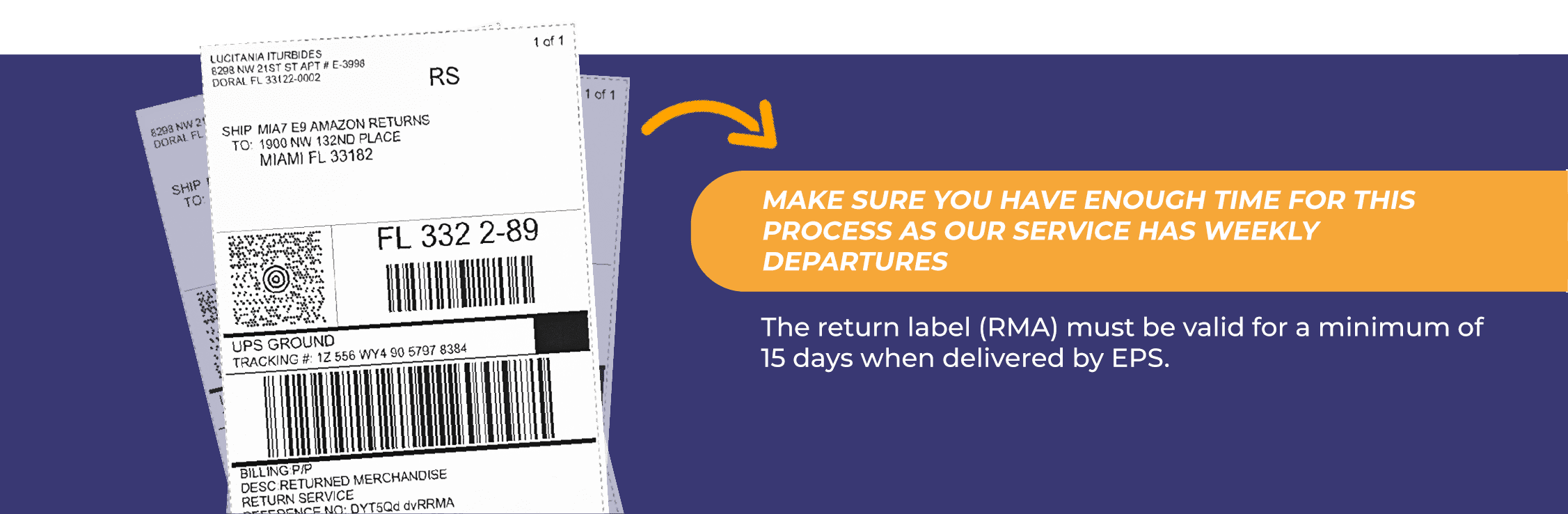

Look for the claims section in the store where you purchased the item and follow their steps to obtain a return label (RMA) that you must print.

Head to your preferred EPS branch or agency, and have the following ready:

Properly pack the item to be returned, to avoid damage during transport. Most stores require the item to be in its original packaging.

This means that all shipments, regardless of their value or country of origin, will be subject to applicable duties and will require a customs entry in the United States.

Duty-free treatment will apply only to shipments valued at up to 100 USD, sent as genuine gifts from an individual in a foreign country to another individual in the United States.

Shipments subject to duty payment may also incur additional Customs charges at destination:

The package must comply with a maximum volumetric weight of 25 pounds, calculated by multiplying length × width × height (in centimeters) and dividing the result by the factor established by EPS. The billable weight will be the greater of the actual weight or the volumetric weight.